Retained by the client (invoice discounting), or

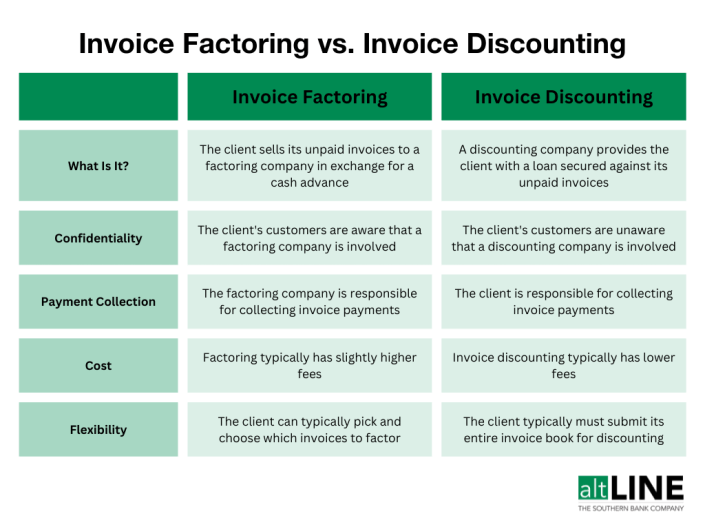

The principal difference between the products is whether the sales ledger administration and collection functions of the client are: It’s not equity because you don’t give up a piece of your company. Probably the biggest misconception students have as regards invoice discounting is the belief that it is a form of discount offered by a company to its customers. For invoice discounting, fees are typically lower than for factoring because you will still collect and manage debts yourself. It’s not a loan because you don’t incur debt. Provides a brief overview of the UK-based trade association for asset based financing (including receivables finance)ĭistinguishing between invoice discounting and factoringīoth invoice discounting and factoring facilities involve the purchase of receivables from a client by the receivables purchaser at a discounted rate. As with factoring arrangements, invoice discounting arrangements can be with recourse or without recourse. Invoice Discounting is the same as Invoice Factoring, but without the credit control. Highlights the challenges that can arise in relation to the purchase of a receivable, and This is most suitable for young businesses. In addition, our factoring company also charge a 2.5 fee of £25.

Our factoring company then retain 20 of the debts until the customers pay the outstanding invoices. Illustrates the invoice discounting and factoring process Our factoring company initially sends us 80 of the outstanding debts. The advantage to the client is that it enjoys a more predictable and liquid cash-flow cycle.Įxplains the basic difference between invoice discounting and factoring Invoice discounting and factoring are types of receivables financing whereby a company, sole trader or partnership, known as the client, sells (ie assigns) its book debts (or receivables) together with all related rights, to an invoice discounter or factor (each a receivables purchaser) at a discounted rate. Well, there is one crucial distinction between invoice discounting and invoice factoring that you’ll need to keep in mind if you’re hoping to access financing secured by your invoices: While invoice factoring will involve third-party collections, invoice discounting won’t. The popularity of financing business through the invoice discounting and factoring of receivables has grown significantly in the UK over the last 25 years. While invoice discounting is similar, you are still responsible for collecting the accounts receivables, while the lending institution provides funding based on.

0 kommentar(er)

0 kommentar(er)